2025 Update: Due to rising costs, the Board of Trustees decided to reinforce Paulding Putnam's financial strength by pausing the retirement of capital credits in 2025. This means eligible members will not see a credit on their December electric bill. (Estates, however, will still be paid out for those who have passed away.)

Paudling Putnam didn’t start retiring capital credits until 1997, when it made financial sense. Listed in our Code of Regulations (Pg 11 - Article VIII, Section 2), the board has the authority to make this decision annually. By keeping these funds inside the co-op this year, we protect future reliability.

If your bill feels heavy, we have free audits, rebates, budget billing, and payment help – just contact the office at 800-686-2357.

What are Capital Credits Payments?

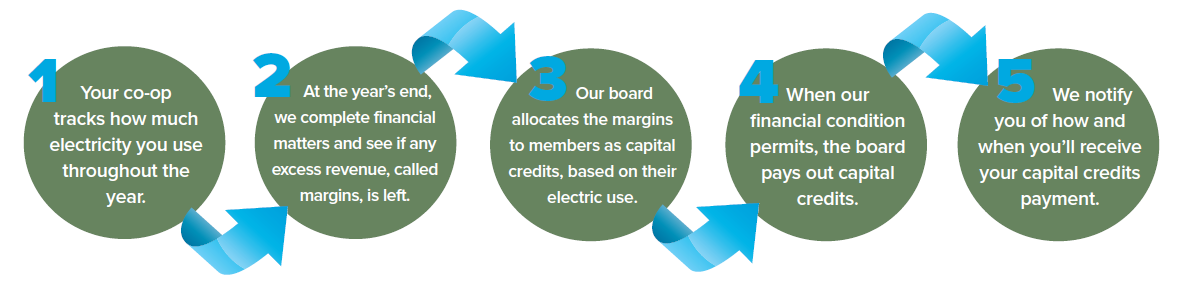

One of the major benefits of being a cooperative member is the receipt of capital credits, which is like money back from your power company.

Here’s how it works: money remaining after Paulding Putnam’s bills are paid each year is known as margins (it is the margin between income and expenses). This money is used for capital expenditures, such as building or replacing lines, and is not paid back immediately. This becomes your investment or equity in the company. In a for-profit company, this money would be called profit. To be a true nonprofit cooperative, we believe this money should be returned to you – we call it capital credits.

We keep track of your capital credits in a special account. You receive a notice each year telling how much money from the previous calendar year’s margins was allocated to your account. This is money we will eventually refund to you or your estate. The amount of patronage capital allocated to your account is in proportion to the dollar amount of electricity you used. In other words, if you paid for 1 percent of the power we sold, you would receive a 1 percent share of the margins left over at the end of the year. If a member passes away, we pay all capital credits at its net present value.

Capital Credits usually are issued or returned to you in December, because we know many members need the extra cash during the holiday season. If you are a current member, you will see this as a credit on your energy bill. If you are a past member who is owed a capital credit, you also will receive this refund. This is why it’s important to keep your address with us updated, even after you move, so we can always mail you your due money.

Concern for community is a big part of the cooperative difference and Paulding Putnam members have donated over $1 million back to local organizations through Operation Round Up. You can now allocate your capital credits into the fund to help support local nonprofits.

Another way we prove the value of the cooperative difference is when we work with legislative leaders on your behalf. For as little as $25 per year ($2.08 per month) you can join America’s Electric Cooperatives Political Action Committee (PAC) and fight to keep rates affordable.

If you would like to reinvest your capital credits into our Operation Round Up prograam or political action efforts to ensure your voice is heard by lawmakers, please complete the form below and return it to us via email, mail, or stopping by our office. Please call us at 800-686-2357 with any questions.

CAPITAL CREDIT POLICY #A012

PAULDING PUTNAM ELECTRIC COOPERATIVE, INC.

PAULDING PUTNAM ELECTRIC COOPERATIVE, INC. GENERAL POLICY ON THE RETIREMENT OF CAPITAL CREDITS

I. OVERVIEW: 1. This policy shall support the intentions of the Code of Regulations and shall in no way supersede or change the Code of Regulations. In all cases, the Code of Regulations shall be the final determination in regard to capital credit retirements. See Article VIII of PPEC’s Code of Regulations.

2. It is the desire of the Board of Trustees to retire capital credits annually to the membership, this includes both general and estate retirements. PPEC’s management shall plan and budget for the annual retirement and such amount shall be approved by the Board of Trustees as part of the annual operating & capital budget of the PPEC.

3. All funds collected in excess of total expenses (operating & non-operating margins) on an annual basis shall be allocated to member patronage capital credit accounts on a pro-rata basis.

4. The Board of Trustees shall approve, as part of the annual budget, the amount of capital credits to be retired during the budget year – both estate and general retirements. Management shall recommend a level of retirement consistent with PPEC’s Budget, Equity Management Plan, Cash Flow Analysis, and the Financial Forecast.

5. The general retirement of patronage capital shall be paid annually to all members of record (for the years being retired) during the month of January. The Board of Trustees approved general retirement amount shall be divided equally between the oldest year on record and the most recent year on record.

6. The Board of Trustees limits estate retirements during the year to a maximum of 25% of the budgeted capital credit retirement amount for that year. Any estate retirements submitted that exceed the 25% will be retired in the following year on a first in first out basis.

7. Surviving Spouse – Estate retirements will NOT be processed to a surviving spouse and that the account simply changes to the spouse and capital credits continue under the spouse’s name.

8. Discounted Estate Retirements – All estate retirements will be discounted to present value based on the established rotation cycle. The discount rate shall be set each year based on PPEC’s average cost of debt for the previous year.

9. Business Retirements – Retirements to a business shall be treated in the same fashion as any other member leaving the system. Businesses that close or transfer ownership must provide legal documentation as to the status of the capital credits. Lacking any legal documents PPEC shall consider the capital credits as assets sold or transferred to the new business or owners. It shall be the responsibility of the business owners to provide legal documents establishing the status of the capital credits.

PPEC needs your help to locate former members

Paulding Putnam is requesting your assistance in locating these members so they may receive the refunds due to them. These former members’ refunds were returned as “undeliverable” by the U.S. Postal Service. Their names are listed below. If you recognize a name on the list, notify the person. If the person is deceased, let one of their relatives know about the unclaimed check. Each year, active members receive a statement showing the amount of their individual capital credit accrual. The money is refunded as designated by the board of trustees. There is a check re-issue minimum of $15.00. For questions, please call the Paulding Putnam office at 1-800-686-2357.